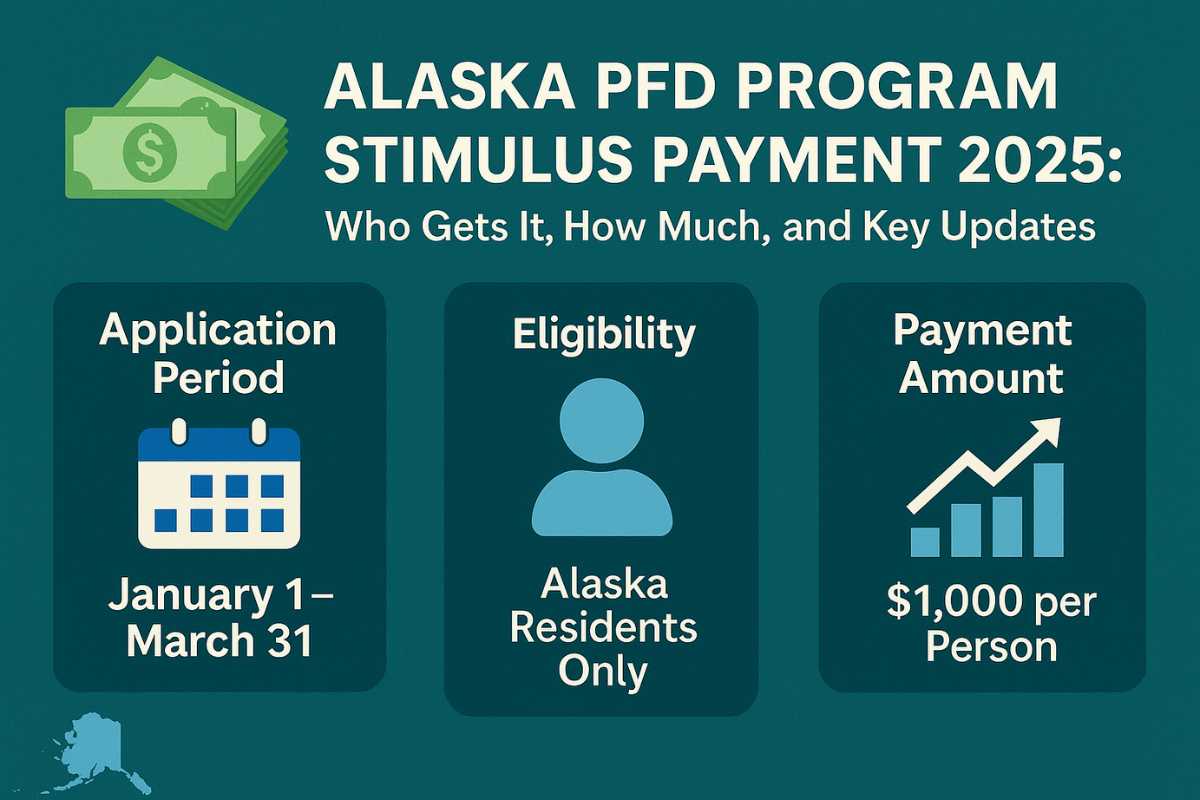

The Alaska Permanent Fund Dividend (PFD) program offers citizens a share of the nation’s oil and mineral sales annually. They received it pressured with a federal government stimulus payment; however, it is really a country-funded software completely in Alaska. For 2025, the PFD amount is $1,000, following the $1,702 received in 2024.

This educational demystifies how the Alaska PFD application works, eligibility, the way to get hold of the charge, and whilst payments may be issued, so all can stay updated and prepared.

What is the Alaska Permanent Fund Dividend (PFD) Program?

The Alaska PFD is an annual dividend to eligible state residents from returns at the Alaska Permanent Fund, established in 1976. The fund invests a portion of the kingdom’s oil and gas sales, allowing Alaskans to immediately benefit from their natural wealth.

It’s ruled by way of the Alaska Permanent Fund Corporation and changed into set to provide long-term financial benefits for the people. While generally called a “stimulus price,” the PFD is really not a federal stipend.

How the PFD Amount is Determined

- Review Fund Earnings: The Alaska Department of Revenue begins by reviewing the Permanent Fund’s earnings over the past five years.

- Take a Five-Year Average: The average income from those five years is used to determine the available amount for distribution.

- Deduct Administrative Costs: Administrative charges, management fees, and other state appropriations are subtracted from the total fund earnings.

- Calculate the Dividend Pool: The final balance after deductions becomes the dividend pool to be distributed for payout to eligible citizens.

- Divide Among Eligible Applicants: The pool is divided equally among all qualified applicants who meet residency and eligibility requirements.

- Adjust for Economic Factors: The very last figure might also range based on oil prices, investment performance, and legislative price range decisions.

- Set the Annual Payout: In 2024, this technique led to a $1,702 payout according to an eligible Alaskan.

For 2025, the amount decreased to $1,000 due to lower revenues and tighter state budgets.

Eligibility and Application Requirements

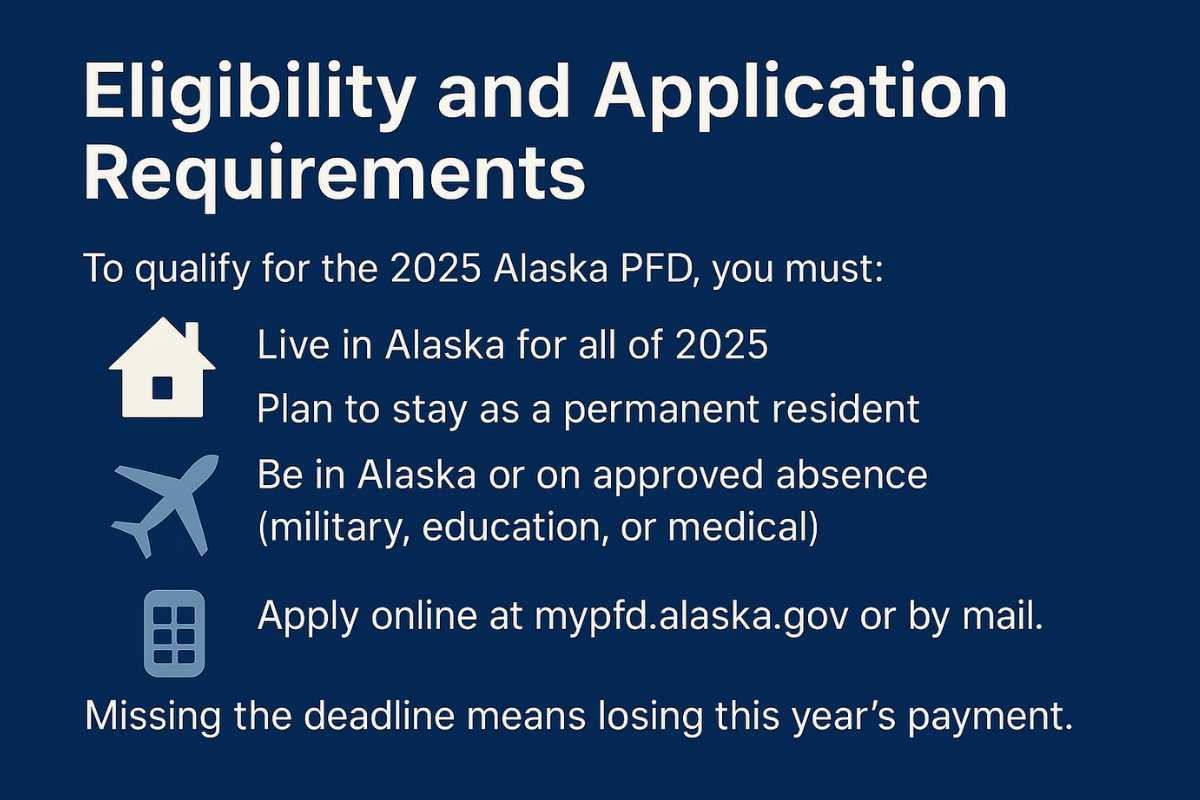

To qualify for the Alaska PFD, a person has to have resided in Alaska for the whole qualifying 12 months, in this example, all of 2024, for the 2025 charge. The applicant has to intend to stay absolutely in Alaska, not be convicted of any felonies that might render him or her ineligible, and characteristic physical been gift in the country for a duration of no much least hour70 hrs constantly inside the preceding years.

Absences lasting over 180 days are generally disqualifying, except for such reasons as training, army service, or medical care. Meeting all of the above requirements is essential for approval.

Check also: Streameast: The Rise, Collapse, and What Comes Next

How to Apply and Track Your Payment

- Applications open January 1 and close March 31 every year.

- Apply online at pfd.alaska.gov or use a paper application.

- Provide valid identification and proof of residency with your submission.

- Select direct deposit for faster payment delivery.

- Track your application status and update bank details through the myPFD portal.

- Avoid disqualification or delay by meeting the March 31 deadline and submitting accurate information.

Tax and Legal Consequences

- The Alaska PFD is considered taxable federal income and should be reported on your return to the IRS.

- Alaska does not have a state income tax; thus, no tax is imposed at the state level.

- However, voluntary federal obligations like child support, court-ordered restitution, or federal loans can lead to garnishments.

- If you move out of Alaska before completing the qualifying year, your eligibility is forfeited.

- Care must be taken to consider these factors before filing, and expect probable deductions.

Also Read: Complete Guide to Education Portals: Meaning, Types & Top Portals Worldwide

Comparison: PFD vs Federal Stimulus Payments

The PFD of Alaska and federal stimulus checks are often confused with one another, but they serve different purposes. The PFD is drawn from Alaska’s oil reserves and is paid annually, while federal stimulus checks were temporary actions nationwide.

It only impacts Alaskan residents who are eligible on specified terms, and it is to distribute state resource revenues, not to provide national economic assistance. Understanding this prevents misunderstanding and highlights the local economic importance of the PFD.

Impact on Alaska Families and Communities

The PFD also greatly impacts the economic status of families and communities all over Alaska. For other families, the payment finances expenses such as heating bills, foodstuffs, and school fees. In rural areas, where the level of living is very high, the PFD balances family budgets.

The annual payment also triggers the economy locally since residents spend more money within the payment period. Besides personal benefits, the PFD positively impacts the economy of Alaska and relieves fiscal burdens on thousands of households.

FAQs

When will I get hold of my 2025 PFD charge?

Direct deposits start on October 2, 2025, and tests are mailed out by October 23.

Can I still observe if I moved out of Alaska?

No, the best Alaska year-round residents who intend to remain here are eligible.

Is the PFD similar to a federal stimulus test?

No, it is a kingdom dividend payment drawn from Alaska oil revenues.

Conclusion

The Alaska Permanent Fund Dividend remains one of the nation’s biggest financial programs, sending a bit of Alaska’s oil riches to citizens each year. Understanding eligibility, closing dates, and tax implications ensures that you’ll receive your payment hassle-unfastened.

The 2025 PFD, even as smaller than last year’s, again suggests Alaska’s sturdy dedication to redistributing its aid earnings returned to its citizens.